ESG/SRI Demand

ESG/SRI Demand

ESG/SRI Demand

ESG/SRI Demand

ESG/SRI Demand

The demand for Environmental, Social, and Governance (ESG) investing or Socially Responsible Investing (SRI) has been growing. But what is the actual size of the market for ESG/SRI investments?

The chart below is from the US Sustainable Investment Forum (US SIF). It is one of the most quoted sources to track the demand of ESG/SRI investments.

We believe this chart, though correct with respect to growth, is inflated in the sense that any assets with any type of ESG/SRI overlay (as determined by the company) are considered ESG assets. Please note that a new methodology, implemented in 2022, cut AUMs in half.

Another widely quoted source for ESG/SRI investment growth is the Assets Under Management (AUMs) for all companies who are signatories of the United Nations Principles of Responsible Investing (UNPRI).

Again, while we acknowledge the growth of ESG/SRI investments, we believe the AUM totals inflate the actual market for ESG/SRI investments. The UNPRI no longer publishes this graph, though it is stated in the 2023 Annual Report that there are over 700 Asset Owners representing $65 trillion AUM.

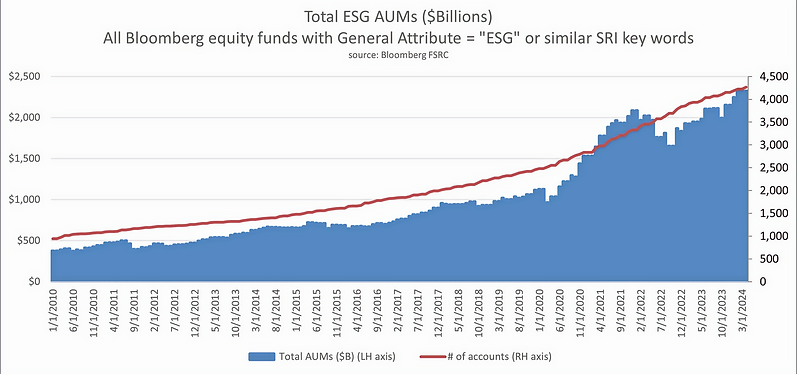

Concinnity believes that the below Bloomberg FSRC graph regarding ESG AUMs is more reflective of the actual ESG investment market.

The below graph was constructed using data from Bloomberg's FSRC screening function. The screen examines all funds in Bloomberg's fund database, including ETFs, mutual funds, hedge funds, investment trusts, and SMAs, that have ESG/SRI key phrases and words in their fund title or description. The funds that pass the screen are specifically describing and marketing themselves as ESG /SRI funds.

This screen demonstrates that the current market for ESG/SRI specific funds is just over $2 trillion AUM from approximately 4,000 funds.

The future demand for ESG/SRI investments also looks promising. Surveys show that the demographic groups that are controlling more and more of the purse strings are the groups most interested in ESG/SRI. As the large wealth transfer from Baby Boomers to Millennials begins, ESG investments are poised to benefit significantly.

The graphs below are from a 2016 US Trust survey. The graphs show that interest in Social Impact Investments has increased over the last three years, and is largest in the following groups:

-

Millennials

-

Gen X

-

Women

-

Ultra High Net Worth Individuals